NEW YORK (AP) — Wall Street closed higher and held near all-time highs amid hopes that moves by Japan’s central bank to keep interest rates easy for investors could be a preview for the rest of the world. The S&P 500 rose 0.6% Tuesday, just shy of its record. The Dow rose 0.7%, and the Nasdaq composite added 0.7%. Japan’s Nikkei 225 was one of the world’s biggest winners after its central bank decided to keep its benchmark rate below zero in hopes of encouraging more borrowing and spending. Hopes are building that the Fed may cut its own interest rates several times next year.

THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below.

NEW YORK (AP) — Wall Street is ticking upward and near all-time highs amid hopes that Tuesday’s moves by to keep interest rates easy for investors could be a preview for the rest of the world.

The S&P 500 was 0.4% higher in afternoon trading, just 0.8% shy of its record set nearly two years ago. The Dow Jones Industrial Average was up 198 points, or 0.5%, coming off its own record high. The Nasdaq composite was 0.4% higher, as of 1:24 p.m. Eastern time.

Enphase Energy jumped 6.9% after the maker of microinverters for the solar energy industry told employees it will cut 10% of its global workforce and make other streamlining changes. Stocks of oil-and-gas companies also helped push the market higher after crude prices rose roughly 1.7% to recover some of their sharp drops from recent months.

Stock markets abroad were mixed in mostly quiet trading. Japan was an exception, and the Nikkei 225 jumped 1.4% after the country’s central bank decided to keep its benchmark interest rate below zero in hopes of encouraging more borrowing and spending.

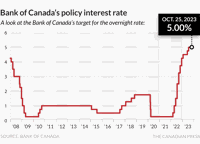

The S&P 500 has rallied roughly 15% since late October on hopes that a similar approach may be coming to Wall Street. With inflation down from its peak two summers ago and the economy still growing, the rising expectation is for the in 2024 to pivot away from its campaign to hike interest rates dramatically.

Fed Chair Jerome Powell seemed to give a nod toward such hopes last week when he did not push forcefully against traders' expectations for several cuts to rates next year. Wall Street loves lower rates because they give investment prices a boost and relax the pressure on the economy and the financial system.

The hope is the Fed can pull off what was seen as a nearly impossible tightrope walk, by first getting inflation under control through high interest rates and then cutting rates before they push the economy into a recession.

A report on Tuesday morning showed the housing industry appears to be in stronger shape than expected. Homebuilders broke ground on many more new homes in November than expected, 200,000 more at a seasonally adjusted annualized rate.

Of course, Wall Street’s big moves also have critics saying the rally looks overdone and that stocks now look too expensive relative to how much profit companies are making. More cautious investors also say the number of rate cuts traders are penciling in for 2024 looks unlikely unless the U.S. economy falls into a recession.

Some Fed officials have been sounding more cautious about the prospect for rate cuts since Powell's comments last week. On Friday, for example, the president of the Federal Reserve Bank of New York said it was “premature to be even thinking” about whether to cut rates in March.

Markets have nevertheless been ebullient, with the S&P 500 coming off its seventh straight winning week for its longest such streak in six years.

Showing how ravenous buyers have become, clients at Bank of America poured $6.4 billion more into U.S. stocks last week than they withdrew. It’s the fourth-largest weekly inflow since it began tracking the data in 2008, strategist Jill Carey Hall said in a BofA Global Research report.

In the bond market, the yield on the 10-year Treasury slipped to 3.93% from 3.94% late Monday. It was above 5% in October, at its highest level since 2007 and putting tremendous downward pressure on the stock market.

Elsewhere on Wall Street, shares of Tylenol maker Kenvue rose 2.7% following a favorable ruling for it in federal court. The company wanted to exclude the opinions of experts in a multijurisdictional against it on whether in-utero exposure to acetaminophen, the pain reliever used in Tylenol and other generic drugs, could lead to autism or attention deficit disorder.

Judge Denise Cote of U.S. District Court for the Southern District of New York agreed with Kenvue, ruling Monday that the testimony was inadmissible.

Alphabet added 0.5% after its that it stifled competition against its Android app store, agreeing to $700 million and making several concessions.

Accenture was swinging between modest losses and gains after reporting stronger results than analysts expected for the latest quarter, but also giving a weaker-than-expected revenue forecast. It was recently down 0.2%.

___

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.